Drivers Digitalks

Scott Painter was one of the speakers at this year's DigitalK

The strength of Fair is in the years of data collection for cars that optimally calculate asset devaluation. Scott Painter and his Fair.com want to change the model of buying and using cars.

Buying a new car has never been a simple endeavor. As one of the great investments that each person is doing, it usually des resources, time and knowledge. There is also a credit risk for an asset with rapid depreciation. In a nutshell, says Scott Painter, this is one of the worst investments one can make. So he has decided to free everyone from this risk and take it on himself.

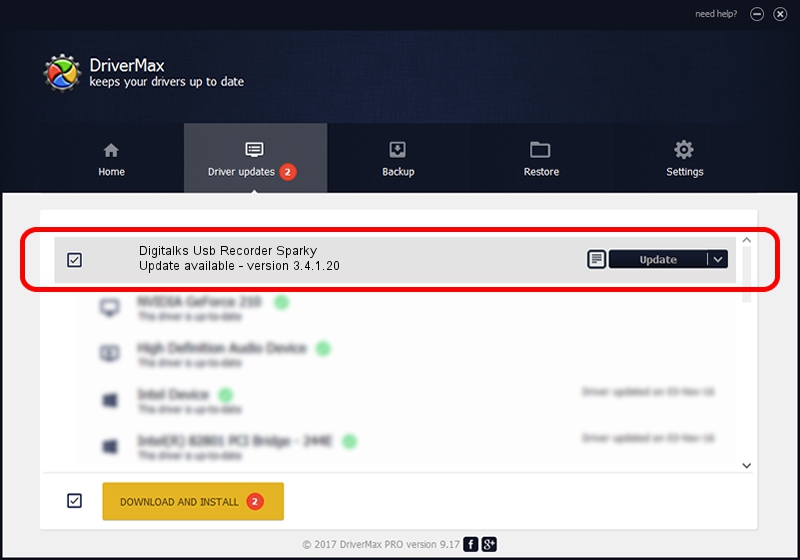

It was interesting to hear about the drivers and barriers for different institutions, as well as learning about the types of resources that institutions have used. A list of all the barriers drivers and resources are available. On a national level, the Building Digital Capability Community of Practice will continue to grow. Your system's drivers are managed by your IT admin through Dell SupportAssist. Contact your IT admin for help updating your system. Checking to see if SupportAssist is already installed on your device. Please wait while SupportAssist checks for driver updates.

Painter is not an altruist, but an entrepreneur. Serial if we judge by his portfolio. Painter, born in Sacramento, California, began his education at Berkley, but only a year later he quit to establish his first company, AUTOAccess, an automated database for used cars.

In 2005 he left AUTOAccess to set up TrueCar - an online platform for selling cars. For the ten years he spent there, Painter became part of the World Economic Forum in Davos, that awarded him the Technology Pioneer Award of 2011. Now Painter has a new venture. In 2016 he founded Fair Inc.

It is an online platform that eliminates all the minuses and costs of owning a car, and offers the use of (almost) new cars. Through the Fair application, everybody can, after a short validation process, rent a car for any period of time - without a pile of documents or financial guarantees. This avoids long-term loans as well as leases, which are usually covering several years. So far, the app is working in the US, but his founders' intention is to become global.

Simple contracts, simple installments

'The industry has long been thinking that the solution to the problem of sales is in creating a better product, but the problem is not in the product, but in the attitude of consumers to distributors. The consumer does not like to buy cars from dealerships', Painter states. His company does not try to fight the attitudes of consumers but to take the place of the car dealers.

'Instead of going to the bank and borrowing a new car, we go to the bank and get credit for everybody. We do not give you money to buy the car and make a contract (all on your phone) while we buy the car and we give you the keys, so you get all the benefits you would have if you bought the car in full, without the depreciation, and every the car comes with insurance and standard service'. The only thing the consumer has to do, the entrepreneur says, is to pay his monthly contribution to Fair.

On the platform the choice is among 13,000 medium to high class cars. The average car cost is about $ 450 per month. All cars are used, but there are not a single model produced before 2014. Family cars such as the Kia Sportage from 2016 at 32,000 km for $ 180 a month with an initial $ 1,200 fee and super cars as the Lamborghini Huracan 2015 for $ 3890 monthly and initial payment of $ 12,300 are offered.

Fair further facilitates the process by offering even its own optional insurance. 'It is clear that we have a license to sell cars, but we are also a licensed insurance company', Painter comments. Thus Fair insures its products cheaper and more reliably. Although such an undertaking is causing an additional heavy burden on the company's capital, Painter is convinced that it is the solution that will bring longevity to Fair. 'Still, you can not find a lot insurance companies that go bankrupt - the business is good.'

The car key - the data

Scott Painter says their main advantage over the lease companies is the price. 'We allow you to take the car for a lot less money without paying the fees that come with the standard leasing. All taxes, insurances and depreciation are included in the fee you pay in Fair. When you get out of the saloon, the car loses 20% of its price, and you can bypass this obstacle, which allows us not to have direct competition with car-selling companies. Instead we are focusing on the market for used cars, which is several times bigger. Another plus of our application is that the contract is maximally simplified. In our case the lease is equal to the rent. When signing a contract is required an advance fee which ensures that you will remain faithful to the contract.'

Painter explains that the car can be returned at any time, but the optimal option for the company is the car to be used between 12 and 18 months.

Here is the essence of his model. The company claims it is much better than others to calculate depreciation and plays at the thin margin between profit and loss from the amortization of these assets. The reason? Years of data collection in the automobile sector.

Apart from Painter himself, the partner of Fair.com is George Bauer, one of the most experienced people in the car industry. Before Fair Bauer was in Mercedes Credit Corporation, founder of BMW Financial Services that has reached 135 billion dollars in assets in more than 75 countries, in Daimler-Benz's Board of directors and was a Tesla Financial Services leader until 2016 also. They both claim to know more about the financial side of the car business than almost everybody else.

According to Fair's internal data, the final price of a car is twice as lower as the traditional rent-a-car. Thus, when the depretiation calculations are accurate, they can give the lowest possible price that does not harm the customer.

The money

As Painter himself admits, trying to own so many cars to rent requires huge capital. That's why the company has been rallying money from various investors, and in 2017 it has raised over $ 1 billion. He then took an operating loan from Goldman Sachs to acquire Xchange Leasing from Uber.

The model is repeated a week later, when Fair, aided by Siemens, collected over $ 100 million to buy another auto startup - Skrut. The acquired company allows you to rent a car and then delivers it to the recipient's address. The aim of this deal is to extend Fair offer to the whole country. For the time being, Fair operates mainly in the US west coast cities of Los Angeles, San Francisco, San Diego.

Now Fair is also Uber's official partner. This means that anyone who wants to be a Uber driver without a car will be referred to Fair. Thus, the company builds a customer base that constantly returns for more.

Painter, however, has goals that go far beyond those to make Fair model runs at full speed. 'In order to reach the optimum size, we need to collect between four and six billion dollars for two years to buy approximately 200,000 cars in different price classes, but the main problem is not the money, but the rate at which we grow,' says the entrepreneur.

To have or to rent

But how does Fair deal with the mentality problem - the desire to own and not to rent a car that is still the predominant attitude? 'There are three main advantages of buying a car: first, the status - this is my car and I show it to everyone, secondly, the comfort - I can get in my car and go everywhere, and thirdly, my child's stool is in the backseat, I do not want to move it to any Uber I get into', Painter says. Fair users receive all three main advantage points without being hit by the biggest problem of having a car - the depreciation.

But the biggest bet of the new company is that the attitudes of new users will change. The pursuit of Fair is all about consumers. 'If they decide that our technology is really innovative, they will use the service, and my 16-year-old son, for example, can not understand how there is anything other than the Fair, and there is no logic in borrowing money to buy a car. He uses the phone for everything - entertainment, music, communication, and it's just as natural to use a phone for your car, so we think that a company such as Fair, based on clarity and honesty, will be the leader in the near future.'

The entrepreneur does not lack a sense of humor. In a Voice of Disruption interview, Painter ironies himself and the startup industry: 'I think big companies (and great entrepreneurs) are solving big problems, and I have not yet solved the problem of buying and owning a personal car.'

Scott Painter was one of the speakers at this year's DigitalK

The strength of Fair is in the years of data collection for cars that optimally calculate asset devaluation. Scott Painter and his Fair.com want to change the model of buying and using cars.

Buying a new car has never been a simple endeavor. As one of the great investments that each person is doing, it usually des resources, time and knowledge. There is also a credit risk for an asset with rapid depreciation. In a nutshell, says Scott Painter, this is one of the worst investments one can make. So he has decided to free everyone from this risk and take it on himself.

Painter is not an altruist, but an entrepreneur. Serial if we judge by his portfolio. Painter, born in Sacramento, California, began his education at Berkley, but only a year later he quit to establish his first company, AUTOAccess, an automated database for used cars.

In 2005 he left AUTOAccess to set up TrueCar - an online platform for selling cars. For the ten years he spent there, Painter became part of the World Economic Forum in Davos, that awarded him the Technology Pioneer Award of 2011. Now Painter has a new venture. In 2016 he founded Fair Inc.

It is an online platform that eliminates all the minuses and costs of owning a car, and offers the use of (almost) new cars. Through the Fair application, everybody can, after a short validation process, rent a car for any period of time - without a pile of documents or financial guarantees. This avoids long-term loans as well as leases, which are usually covering several years. So far, the app is working in the US, but his founders' intention is to become global.

Simple contracts, simple installments

'The industry has long been thinking that the solution to the problem of sales is in creating a better product, but the problem is not in the product, but in the attitude of consumers to distributors. The consumer does not like to buy cars from dealerships', Painter states. His company does not try to fight the attitudes of consumers but to take the place of the car dealers.

'Instead of going to the bank and borrowing a new car, we go to the bank and get credit for everybody. We do not give you money to buy the car and make a contract (all on your phone) while we buy the car and we give you the keys, so you get all the benefits you would have if you bought the car in full, without the depreciation, and every the car comes with insurance and standard service'. The only thing the consumer has to do, the entrepreneur says, is to pay his monthly contribution to Fair.

On the platform the choice is among 13,000 medium to high class cars. The average car cost is about $ 450 per month. All cars are used, but there are not a single model produced before 2014. Family cars such as the Kia Sportage from 2016 at 32,000 km for $ 180 a month with an initial $ 1,200 fee and super cars as the Lamborghini Huracan 2015 for $ 3890 monthly and initial payment of $ 12,300 are offered.

Drivers Digital Signature Error Windows 10

Fair further facilitates the process by offering even its own optional insurance. 'It is clear that we have a license to sell cars, but we are also a licensed insurance company', Painter comments. Thus Fair insures its products cheaper and more reliably. Although such an undertaking is causing an additional heavy burden on the company's capital, Painter is convinced that it is the solution that will bring longevity to Fair. 'Still, you can not find a lot insurance companies that go bankrupt - the business is good.'

The car key - the data

Scott Painter says their main advantage over the lease companies is the price. 'We allow you to take the car for a lot less money without paying the fees that come with the standard leasing. All taxes, insurances and depreciation are included in the fee you pay in Fair. When you get out of the saloon, the car loses 20% of its price, and you can bypass this obstacle, which allows us not to have direct competition with car-selling companies. Instead we are focusing on the market for used cars, which is several times bigger. Another plus of our application is that the contract is maximally simplified. In our case the lease is equal to the rent. When signing a contract is required an advance fee which ensures that you will remain faithful to the contract.'

Painter explains that the car can be returned at any time, but the optimal option for the company is the car to be used between 12 and 18 months.

Here is the essence of his model. The company claims it is much better than others to calculate depreciation and plays at the thin margin between profit and loss from the amortization of these assets. The reason? Years of data collection in the automobile sector.

Apart from Painter himself, the partner of Fair.com is George Bauer, one of the most experienced people in the car industry. Before Fair Bauer was in Mercedes Credit Corporation, founder of BMW Financial Services that has reached 135 billion dollars in assets in more than 75 countries, in Daimler-Benz's Board of directors and was a Tesla Financial Services leader until 2016 also. They both claim to know more about the financial side of the car business than almost everybody else.

According to Fair's internal data, the final price of a car is twice as lower as the traditional rent-a-car. Thus, when the depretiation calculations are accurate, they can give the lowest possible price that does not harm the customer.

The money

As Painter himself admits, trying to own so many cars to rent requires huge capital. That's why the company has been rallying money from various investors, and in 2017 it has raised over $ 1 billion. He then took an operating loan from Goldman Sachs to acquire Xchange Leasing from Uber.

The model is repeated a week later, when Fair, aided by Siemens, collected over $ 100 million to buy another auto startup - Skrut. The acquired company allows you to rent a car and then delivers it to the recipient's address. The aim of this deal is to extend Fair offer to the whole country. For the time being, Fair operates mainly in the US west coast cities of Los Angeles, San Francisco, San Diego.

Now Fair is also Uber's official partner. This means that anyone who wants to be a Uber driver without a car will be referred to Fair. Thus, the company builds a customer base that constantly returns for more.

Painter, however, has goals that go far beyond those to make Fair model runs at full speed. 'In order to reach the optimum size, we need to collect between four and six billion dollars for two years to buy approximately 200,000 cars in different price classes, but the main problem is not the money, but the rate at which we grow,' says the entrepreneur.

To have or to rent

But how does Fair deal with the mentality problem - the desire to own and not to rent a car that is still the predominant attitude? 'There are three main advantages of buying a car: first, the status - this is my car and I show it to everyone, secondly, the comfort - I can get in my car and go everywhere, and thirdly, my child's stool is in the backseat, I do not want to move it to any Uber I get into', Painter says. Fair users receive all three main advantage points without being hit by the biggest problem of having a car - the depreciation.

But the biggest bet of the new company is that the attitudes of new users will change. The pursuit of Fair is all about consumers. 'If they decide that our technology is really innovative, they will use the service, and my 16-year-old son, for example, can not understand how there is anything other than the Fair, and there is no logic in borrowing money to buy a car. He uses the phone for everything - entertainment, music, communication, and it's just as natural to use a phone for your car, so we think that a company such as Fair, based on clarity and honesty, will be the leader in the near future.'

Driver Digital Signature

The entrepreneur does not lack a sense of humor. In a Voice of Disruption interview, Painter ironies himself and the startup industry: 'I think big companies (and great entrepreneurs) are solving big problems, and I have not yet solved the problem of buying and owning a personal car.'